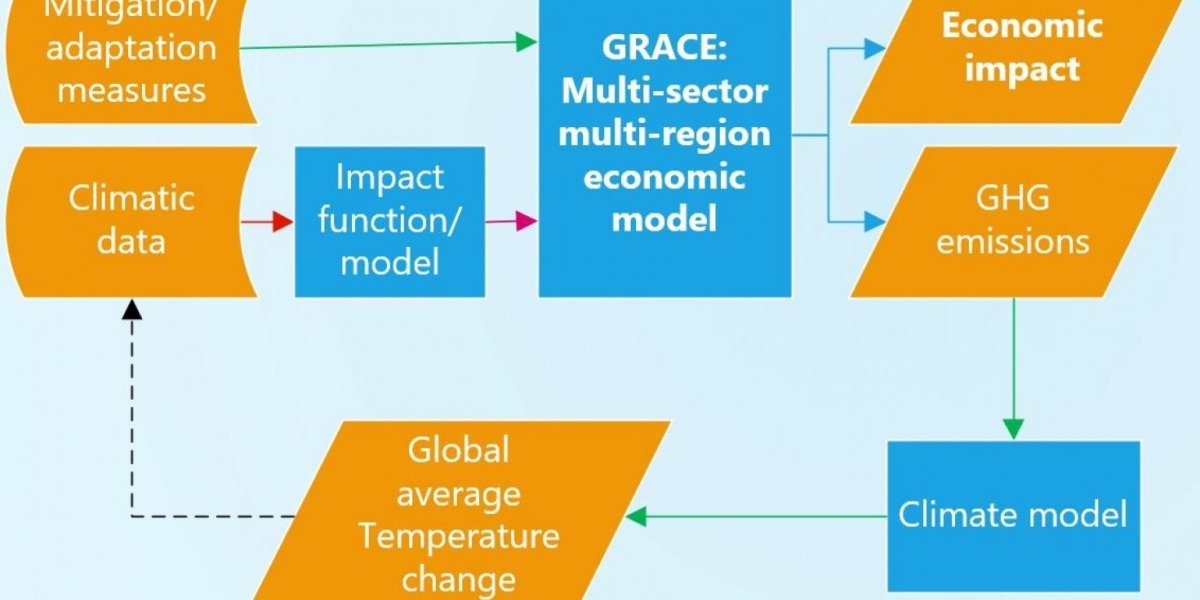

Overiew of GRACE, CICEROs economic equilibrium model

The Grace Model

GRACE is an economic equilibrium model developed and maintained by CICERO to investigate how climate change and related policies affect each other.

GRACE (Global Responses to Anthropogenic Changes in the Environment) is a computable general equilibrium model developed to analyse economic consequences of climate policy and impacts of climate change to the world economy. The model divides all economic activities in the world into regions and economic sectors, and uses projections of population, investments, assumptions on technological change, and climate change, to estimate how economic indicators defined in the national accounts are affected. Climate policies are represented by e.g. quotas or taxes on emissions, to show the economic consequences in world regions under the underlying projections.

Because of its comprehensiveness, the model applies in studies of issues where sectoral and regional development depends on global development. It thereby represents a door opener for putting insights from research on different issues related to climate change into a global context. When possible, this is done by linking variables in GRACE to quantifications from other studies. The comprehensiveness also implies vast generalizations, which seldom matches delineations of the information provided from more focused studies. To make this information applicable, selected equations in GRACE can be replaced by an expanded set of equations, called modules, which transforms results from other studies to variables applicable in a consistent framework.

What GRACE tells us

GRACE connects observations of transactions between economic sectors and between producers and consumers to the possibilities and motives of firms and individuals. The results are interpreted as the global consequences of changes in alternative economic opportunities, or framework, for firms and individuals when firms minimize costs and individuals maximize utility. A major cause of climate change is that individuals and firms do not have sufficient motives to act according to their own interests. Each and one can choose to act according to the interests of the society, for example by reducing their own carbon footprint, but do not benefit unless everybody else do the same. For help to explore the resulting challenges and find ways to deal with them, GRACE explains the global consequences of shifting framework underlying the economic behaviour of firms and individuals.

The model covers all economic transactions in the world. It thereby provides an explanation to the most important drivers of climate change, and derives expected consequences for the economies. This prepares the ground for three areas of usage.

- Assess impacts and consequences of climate policies in different countries and regions, and of cooperation between countries. The model indicates what impacts climate policies and climate change have on the economies over time and how they propagate to economic sectors and regions. This shows how burdens related to climate policies and those related to impacts of climate change are allocated between sectors and regions over time.

- Integration of knowledge. By connecting global economic indicators to the framing of individual decision-making, the model provide guidelines to how insights from research on different aspects of climate change can be integrated. Integration contributes to enhance the value of research with a narrower scope.

- Identification of knowledge gaps. New knowledge on drivers behind climate change and on the impacts of climate change do represent steps forward, but do not always provide a better understanding of what steps to take. Despite this, research is often presented with a clear message, but without any clarification of what knowledge is lacking to link the research to the message. In this context, the guidelines for integration of research on different aspects implicit in GRACE help to identify knowledge gaps.

The economic framework

In GRACE, all economic agents are supposed to act in response to their individual economic framework, or constraints. Consumers are constrained by their monetary income, and firms by the availability of economic resources (labour, real capital and natural resources) and technologies. Both consumers and firms make their choice of goods and services depending on market prices.

Climate change affects the economic framework in different ways. It will change the productivity of natural resources in agriculture, forestry, fisheries, and renewable energy. Extreme events and sea-level rise will damage real capital, possibly in all sectors, and health effects will affect the productivity of labour in all sectors. Climate change will also affect the demand for goods or services related to certain kinds of tourism, and for energy used for heating and cooling. In GRACE, these impacts are estimated from climate projections consistent with the emissions generated under a given pathway for economic development.

Climate policies can be implemented in different ways, depending on the specification of sectors. In most cases, policies are represented by taxes on emissions of greenhouse gases or by taxes implicit from fixed quotas on the emissions.

Modelling structure

The model is based on the general theory of market equilibrium. The theory relates the output in a sector to input of capital, labour, natural resources and deliveries of goods and services, and interpret the observations of input as necessary to produce the observed output. Likewise, observed consumption of goods and services is interpreted as the achievable level of welfare for the population. It is assumed that firms minimize the costs to cover the demand for their output and consumers maximize their utility at the current level of income. The composites of goods and services in production sectors and in consumption depend on the prices of different goods and services. These appear at the level where the supply from a given sector in a given region equals the world demand for this output.

Both firms and consumers choose what goods and services to use depending on prices. How flexible their choices are depends on the technologies in firms and on the consumers’ preferences. A change in the <economic framework> leads to an imbalance between the supplied and the demanded amount for the output in one or more sectors in one or more regions. To restore equilibrium, market prices will change, and motivate all economic agents to adjust their choice on production and demand accordingly.

The basic version of GRACE applies a standard set of assumptions used in most computable general equilibrium models. These may be changed in separate studies. The most important among the standard assumptions are:

- Constant elasticity of substitution (CES) in production and consumption: A change in the relationship between the inputs of two goods has the same effect on the level of production, independent on the initial relationship between the levels used of the two goods. The same applies for the effect on the level of utility of a change in the relationship between the consumption of two goods.

- CES-trees (separability): The rates of substitution between the use of given sets of goods and services in production as well as in consumption are independent on the rates of substitution between other sets of goods and services.

- Market equilibrium: The output from a given sector in a region equals the domestic and foreign demand from this output in other sectors and from end deliveries

- Armington import functions: The demand from all goods and services are divided into demands from the same region and demand from each of the other regions. The trade changes according to changes in relative prices

- Zero profit: All income can be traced to earnings from the use of labour, capital or natural resources (zero-profit assumption)

- No capital market: All income is spent on private and public consumption, or on investments in real capital.

- Full utilization of all resources: All available productive resources (labour capital and natural resources) are being fully utilized, meaning there is no unemployment or “dead” capital.

To run GRACE over several years, one needs projections of the <economic framework>, which includes investments, changes in levels and composites of input needed to produce a given output (technological change), and population. By relating emissions to a selection of sector outputs and inputs, one may derive emission pathways consistent with the <economic framework>. By use of climate projections from the same emission pathways, the impacts of climate change is derived from the impact functions.

Data base

GRACE applies national accounts data from Global Trade Analysis Project – GTAP. The data base provides the value of deliveries from 57 sectors in 140 world regions, most of them nations, to other sectors and to end users (private and public consumption and investments) in all regions in a given year (input-output matrix). In addition, the database includes data on contributions from labour, real capital and natural resources in each sector, all measured by the observed values.

The data are collected from national accounts in the respective countries, but adjustments have to be made to match trade patterns (imports from country A to country B has to match the exports from B to A) and figures from each country have to be adapted to a common definition of sectors and financial flows. Therefore, there may be notable differences between the official national accounts data from a country and the national account figures reported in GTAP.

When using GRACE, several sectors and countries are grouped together, and the model is seldom run with more than 15 sectors and 15 regions. However, it is easy to change the composites of sectors and countries, and the choice depends on the purpose of the study.

Limitations

In principle, the model includes all economic transactions in the world. Its comprehensiveness and the general approach taken to describe economic behaviour implies that the model is subject to a long range of limitations and weaknesses. The most apparent can be divided into three categories:

- Data

- Aggregation

- Description of economic behaviour and economic relationships

- Impacts of climate change

Data

Data from national accounts reported by each country are not set in stone, and the adjustments needed to coordinate data from many countries add to the uncertainties in the data. Moreover, some essential data for the modelling do not refer to observations, but appear as residuals, such as the contributions to the value of production from real capital and natural resources.

The mismatch between the GTAP data and national accounts data published by the countries themselves implies that studies of a given country may be of limited value, in particular for small countries, where the corrections may be substantial. This explains why the model has not yet been used much to study climate policy and impacts of climate change in Norway. To make the model better describe the Norwegian economy reflected by the Norwegian national accounts, the GTAP data for Norway may be replaced by numbers from the Norwegian national accounts, with adjustments for foreign trade and possible differences in the definitions of flows.

Aggregation

The resolution of input data in GRACE is limited to the national borders on an annual basis, and to the sector resolution in national accounts (GTAP). In any case, each sector within a country comprises a broad set of activities, where the composites may vary a lot across countries. For most applications with GRACE, where sectors and regions in most cases are limited to less than 15 of each, these differences expand.

Impacts of climate change, on the other hand, may vary substantially over small distances and be due to events that last over less than a day. Climate projections with high resolutions may capture these, but it is impossible to utilize this information fully to estimate impacts in GRACE. On the other hand, the stringent link between the motivations underlying individual behaviour and the resulting impacts on aggregates helps reveal weaknesses in drawing conclusions on the aggregated scales from insights from focused studies.

Description of economic behaviour and economic quantities

Economic decisions and market responses are described under the assumption of fully competitive markets. This implies that no economic agents have enough market power to make an influence on how prices will change in response to their own behaviour. The model is also based on assumptions on how priorities over goods and services in consumption and production will change over time. This ignores possible shifts due to unexpected technological shifts or radical changes in preferences.

The economic agents moreover demand the aggregated output from sectors, which consists of composites of widely different goods and services. It is impossible to establish an exact link between the quantities used in the model and physical quantities. However, this applies in general to explanations of how physical changes affect decisions. The best one can do is to establish a relationship between observations that reflect the concerns of the decision maker and a physical quantity, knowing that there is not an exact link between the two.

Impacts of climate change

The impacts represented in GRACE are estimated with reference to relatively few studies, and there is considerable uncertainty about them. This reflects a lack of knowledge, in general, but is also related to the problems in deriving the impacts on an economic aggregate from physical changes. Consequently, better representation of the impacts will contribute to a better understanding of the economic consequences of findings in studies that focus on the physical changes. A more transparent linkage between the economic volumes and the physical effects of extreme events and health effects seems particularly important, because these effects have broader economic consequences than most other physical effects.